Fintechzoom Apple Stock Performance: A Deep Dive

This implies that Apple is the stock that has captured ground lately as one of the best-covered stocks on the street. The performances most often reflect more prominent sector trends. Fintechzoom Apple Stock, showing an excellent regard for in-depth financial analysis, provides an overall insight regarding the path of the Fintechzoom Apple Stock. Apple’s performance with a view into Apple stocks through the unique sight lens of Fintechzoom provides detailed analysis focusing both on the historical approach and predictive; all these to enable informed views by investors to ascertain what will happen about their stocks.

Past Performance of Apple Stocks

Historical Significance for the Fintechzoom Apple Stock

Apple has had its fair share of historical milestones on the stock journey. The company began its public voyage in 1980 and became the first to touch a trillion-dollar valuation. This is, without a doubt, a string of breakups. With every launch, whether the iPhone, iPad, or MacBook, there has been significant growth in the market, breaking previous highs on more than one occasion. This makes Apple a strong stock with a reputation that can be seen as not being adversely affected by the economic cycles and investor sentiments.

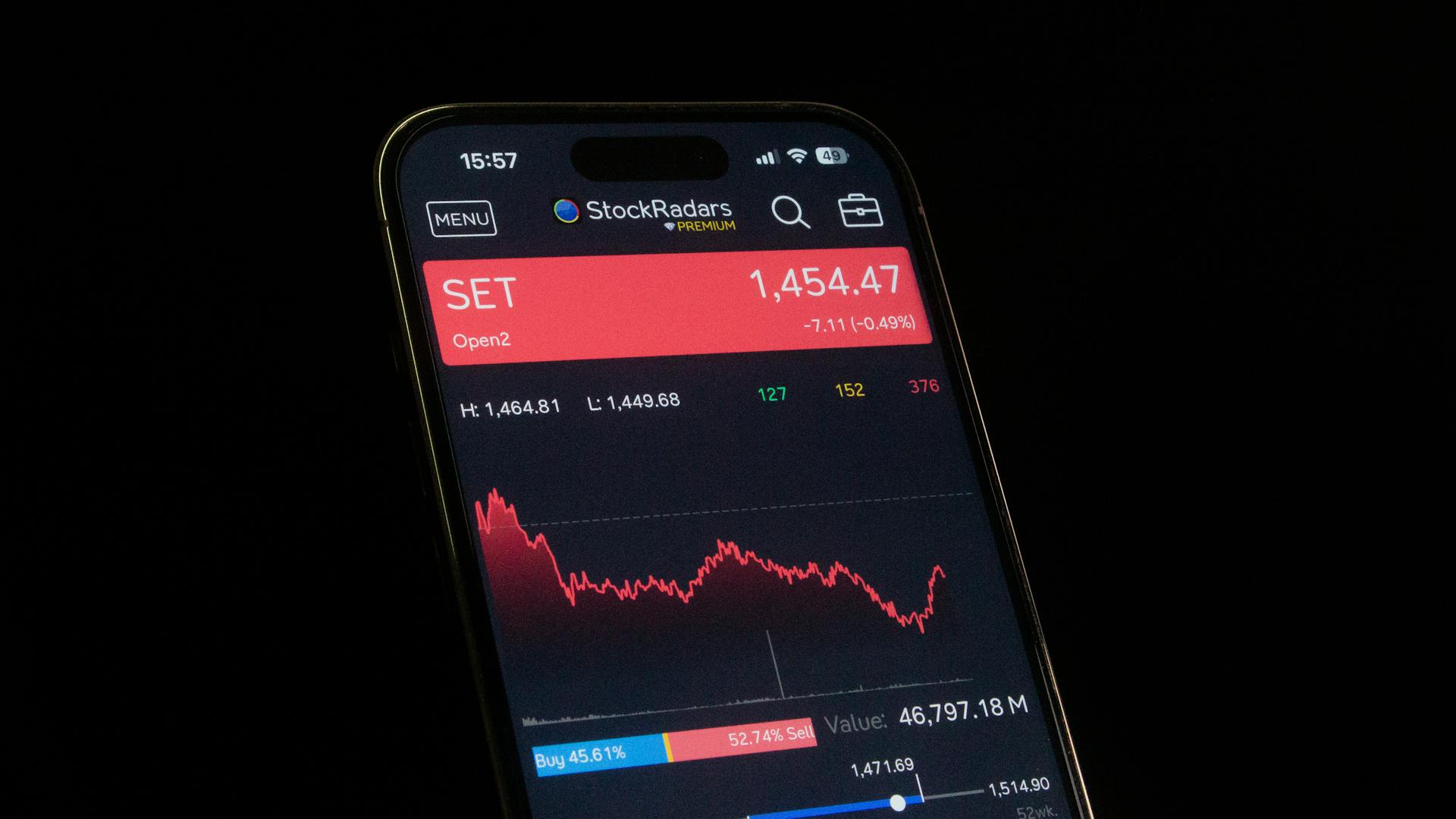

Notable Trends of Stock Performance

Apple’s stock has tended to trade in cycles over the years. Spikes follow post-earnings reports and new product announcements, while dips sometimes occur when expectations are brought down. While there is short-term volatility, long-term growth for Apple has been consistently upward, giving long-term investors steady appreciation. Fintechzoom identifies these patterns, helping investors predict potential movements based on previous behaviors and seasonal trends.

View about Fintechzoom Apple Stock

Other than tracking its prices, Fintechzoom approaches its technical analysis by integrating real-time data as the core strategy in analyzing Apple’s stocks. The use of complex algorithms helps ascertain the investors’ feelings about the macroeconomic, political, and competitive investments at which the macroeconomic events could have influenced Apple’s results. Hence, the stratified approach in analyzing the site makes Fintechzoom a website for analyzing the nuanced trends in Apple’s stock.

Determinants of Value of Fintechzoom Apple Stock

Market Conditions and Economic Variables

From the above, it is clear that the general economy impacts Apple’s stock. Its interest rates, inflationary pressure, and even economic stability at a global level could significantly affect its price in the stock market. The better the general state of the economy, the higher the level of investment will be, as the confidence to invest in Fintechzoom Apple Stock increases, increasing the stock prices. When times get rough, for instance, during the pandemic, though it has remained solid, it would still feel some effect on the stock price. Looking at all these factors from the macroeconomic variable helps Fintechzoom share insight that could be reflective of how long it takes for the trend to shift with regard to the stock.

Innovations and Product Releases Impact

Being stock-sensitive to the innovation pipeline, new product releases often act as catalysts. Investors tend to be increasingly exuberant over these prospects when they sometimes even create value records. Further investment becomes more attractive in light of new technologies like AI advancement, AR advancement, etc. Fintechzoom keeps track of Apple’s innovative product roadmap, which explains how innovation will influence subsequent years of stock performance.

Comparative Analysis: Apple Stock vs. Competitors

Apple operates in a highly competitive landscape, competing with its technological giants such as Microsoft, Google, and Amazon. The comparative analysis of Fintechzoom revealed that while there are general market drivers that Apple shares with its competitors, Apple tends to outperform because it boasts loyal consumers and diversified revenue streams. Apple stock often benefits from its ability to differentiate itself through premium quality in its products and brand reputation. This competitive advantage puts Apple in a position that continues to strengthen investor confidence in its market strength.

Key Takeaways from Fintechzoom on Apple Stock Future

Fintechzoom’s opinion on Apple’s future is based on past information and leading indicators. According to the platform, Fintechzoom Apple Stock will continue to grow, though this will be at ebbs and flows dictated by economic and industrial trends. Potential hotspots to watch will be new emerging areas, including Apple’s possible move into electric vehicle space and all the latest health technologies innovations. Based on those analyses, Fintechzoom assumes that the giant company’s new impulse into new fields, combined with investment psychology and a series of further strategic investments, will likely lead the stock further up.

Conclusion

For over a decade now, Fintechzoom Apple Stock has remained an anchor of investment for all tech investment; a combination of historical strength and resilience, plus robust brand equity, not forgetting unrelenting innovation, drives Apple’s appeal among tech investors. With that amount of analysis from Fintechzoom, Apple seems clear enough to most investors. Indeed, this kind of commitment to the new means this stock will still have appeal in the near term: investors will be attracted to stability and the high-growth area simultaneously.