In today’s rapid growing business environment, organizations need tools that help them to manage finances with accuracy, effective, and efficient. As finance departments become increasingly digitized, financial management software has emerged as a solution that provides businesses with real-time data, streamlined processes, and increase financial control. Workday Financials is one of the leading tools in this world, providing companies with a complete suite for financial planning, management, and reporting.

This guide hunt through into Workday Financials and its standout features, showing how it helps businesses improve their financial operations.

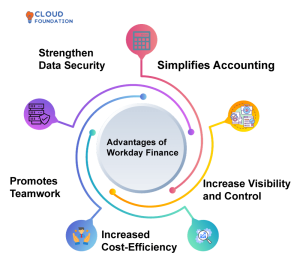

Introduction to Workday Financials

Workday Financials is a remoted financial management solution designed to meet the needs of modern organizations, from small businesses to large entrepreneur. With its fully complete approach, it supports companies in navigating the difficulties of finance, accounting, purchase, and reporting, offering tools that help to improve efficiency and data accuracy.

By the passage of time all type of business needs to find some effective way to make an efficient progress to show their presence in market.

To compete with your opponent, need some tools and equipment’s for improves the Workday financials activities with more accurately and result oriented that will also help to gain attention of the world wide entrepreneurs.

For attention of foreign clients really need to ensure the compliance organization standard and regulatory requirements across the different geographic.

One important that should be remembered that stay on top of regulatory requirements and manage the risk with integral submission and audit features.

In short Workday Financials empowers you to manage resources effectively and make good discussion regarding funding, paying and collecting money. The Workday settlement engine gives to idea into all transactions like spending, revenue , finance and payroll.

Key Features of Workday Financials

1. Current Financial Reporting and vision

Feature Overview: Workday Financials provides current financial insights, allowing finance teams to make numerical decisions quickly. The software continuously updates financial data, allowing instant access to current financial reports.

Benefits: Current data empowers businesses to respond faster to financial trends, detect potential risks, and take energetic steps to address them. This feature is particularly useful for strategic planning and prediction, as it allows for an instant vision.

2.Coordinated System for Financial and Human Resources

Feature Overview: Workday Financials is part of the Workday platform, which includes Human Capital Management and other modules. This unity facilitates stable data sharing between finance and Human resources departments, improve the multipurpose partnerships.

Benefits: A coordinated data system improves correction in workforce cost reporting, budget allocations, and project cost management. Companies save time on manual data transfers, leading to better data integrity and improved decision-making.

3. Technology of Financial Processes

Feature Overview: Workday Financials robotics many financial tasks, including accounts payable, accounts receivable, and expense management. Automation minimizes manual aids and reducing the risk of errors.

Benefits: Automated processes not only speed up operations but also ensure accuracy. This feature allows finance teams to focus on planned tasks, driving productivity and increase financial governance.

4. Improve Submission and Audit willingness

Feature Overview: Workday Financials includes strong audit trails, adjustable controls, and compliance frameworks to meet regulatory requirements. Users can establish security and submission protocols tailored to specific needs.

Benefits: With a focus on audit willingness, Workday helps reduce the risk of non-submission and provides easy access to data for internal and external audits. Businesses benefit from peace of mind knowing they’re lined up with financial requirements.

5. Extensive Revenue Management

Feature Overview: Workday Financials includes advanced revenue recognition capabilities, ensuring compliance with financial reporting standards like upgrade version. It allows companies to recognize revenue according to contractual performances liability accurately.

Benefits: The ability to comply with revenue recognition standards helps businesses maintain improvement in reporting and financial projections. This feature is particularly beneficial for subscription-based businesses and industries with complex revenue flows.

6. Unity Capabilities with Other Systems

Feature Overview: Workday Financials supports unity with third-party systems and other Workday modules like obtaining and Adaptive Planning. Through design and unity tools, businesses can connect Workday to resourced and other platforms.

Benefits: Stable integration with other systems improve data flow, reduce silos, and enables entire business analysis. This feature is important for companies with complex data needs, as it allows information to flow across systems without any hurdle.

Workday Financials VS Other Financial Management Software

While several financial management solutions are available, Workday Financials stands out due to its extensive nature, flexibility, and significant on a unified data system. Compared to competitors like diviner and drain, Workday offers:

User-Friendly Interact: Known for its ease of use, Workday’s intuitive design ensures accessibility across departments.

Scalability: Workday Financials link to both small businesses and global enterprises, with options to scale and customize as organizations grow.

Consolidation-Driven Approach: Workday’s seamless consolidation capabilities, especially within its suite, provide a streamlined experience for organizations seeking an all-in-one solution.

Best Practices for Maximizing Workday Financials Improvements

To get the most out of Workday Financials businesses should consider the following best practices:

1. Comprehensive Training for Users: Ensure that all users are trained not only on the software’s basic functionalities but also on advanced features that align with the company’s specific needs.

2. Leverage Real-Time Analytics: Use the real-time data insights to guide decisions, monitor cash flow, and manage budgets proactively.

3.Customize Dashboards: Tailor dashboards and reports to display KPIs relevant to your business, providing stakeholders with easy access to essential data.

4.Regular Updates and System Maintenance: Keep the system updated to leverage new features and functionalities that enhance financial efficiency.

Exploring the Integration Capabilities of Workday Financials

Workday Financials is designed for easy integration with other systems, enabling companies to leverage a cohesive technology stack. These integrations include:

1. enterprise resource planning and Customer relation management Platforms: Connecting with enterprise resource planning and customer relation management systems allows Workday Financials to integrate customer data, sales figures, and operational insights with financial reporting.

2. application programming interface Integration: Workday offers application programming interface to facilitate integrations with other software, allowing businesses to manage multi-platform operations smoothly.

3.Integration with Workday Flexible Planning: This integration supports financial planning and budgeting, helping businesses adjust short-term goals with long-term planning.

Challenges and Considerations When Implementing Workday Financials

While Workday Financials offers extensive benefits, implementing the software can present challenges:

1.Initial Setup Costs: The software may involve a high upfront investment, especially for smaller companies.

2.Learning Curve: Like most advanced software, Workday Financials requires training and time for teams to get comfortable with its features.

3.Data Migration: Transferring data from legacy systems to Workday can be complex and may require additional resources or support.

Who Should Use Workday Financials?

Workday Financials is suitable for a variety of organizations, including:

1.Large Enterprises: For companies with complex financial needs, Workday’s advanced technology and analytics capabilities offer important advantages.

2.Small and Medium Businesses: Small and medium business seeking to grow and simplify their financial operations can benefit from Workday’s scalability.

3.Industries with Unique Financial Needs: Industries like healthcare, education, and tech that require strict compliance and real-time insights find value in Workday’s features.

Frequently Ask Question’s

1.What makes Workday Financials unique compared to other financial management software?

– Workday Financials is designed as part of the broader Workday suite, enabling consistent integration with Human Resources, planning, and obtaining tools for a holistic view of business operations.

2. Is Workday Financials suitable for small businesses?

– Yes, Workday Financials can be tailored for small businesses. Its adjustability and elasticity make it accessible to companies of all sizes.

3. How does Workday Financials ensure data security and compliance?

– Workday Financials includes integral compliance frameworks, audit trails, and security protocols to safeguard sensitive financial data.

4. Can Workday Financials interacted with non-Workday products?

– Yes, Workday Financials supports application programming interface integrations and can connect with third-party enterprise resource planning, customer relationship management, and other business systems.

5. How long does it take to implement Workday Financials?

– Implementation timelines vary based on the organization’s size, complexity, and integration needs, typically ranging from several weeks to a few months.

Conclusion

For businesses looking to simplify and modernize their financial operations, Workday Financials offers a complete suite of tools that increase efficiency, accuracy, and directed data decision-making. From real-time reporting and technology processes to stable combination, Workday Financials stands out as a valuable solution for companies of all sizes. By adopting best practices and searching its full potential, businesses can transform their financial management, allowing them to stay active, compliant, and ahead of the competition.